Investors and analysts look to several different ratios to determine the financial company. This shows how well management uses the equity from company investors to earn a profit. Part of the ROE ratio is the stockholders’ equity, which is the total amount of a company’s total assets and liabilities that appear on its balance sheet. Shareholders are primarily interested in a company’s stock-market valuation because if the company’s share price increases, the shareholder’s value increases. Stakeholders are interested in the company’s performance for a wider variety of reasons.

That means they have a limited liability as far as the obligations of the company are considered. Profit Must is being built by a passionate team with in-depth understanding of the IPO sector and stock market. The team does their own research reducing employees’ hours during covid and publishes articles on Profitmust.com based on their findings. As a group, we attempt to provide thorough details on forthcoming IPOs, Grey Market Premium, Financial Details, Risk, and firm reviews based on the DRHP and RHP.

- Creditors who are stakeholders in a company will also be treated with unequal shares of interest.

- Civic leaders want the company to remain an employer of the area’s residents and to contribute to tax revenue.

- Common stockholders have voting rights on critical areas such as mergers and acquisitions.

- This means both a stockholder and shareholder have an ownership interest in the company.

Taking care of the shares in terms of stock is the main work of the stockholder. A stockholder is a single person or group of companies where they will own the stocks of the shares invested by the shareholders. If you have shares of stock, you may have received a proxy notification from the company. Since many shareholders are not able to attend the annual meeting, they can vote by proxy.

Shareholder theory vs. stakeholder theory

The terms shareholder and stakeholder are sometimes used interchangeably, but they’re actually quite different. A shareholder is someone who owns stock in your company, while a stakeholder is someone who is impacted by (or has a “stake” in) a project you’re working on. Learn about the key differences between shareholders and stakeholders, plus why it’s important to consider the needs of all stakeholders when you make decisions.

Marathon Oil Reports Second Quarter 2023 Results – PR Newswire

Marathon Oil Reports Second Quarter 2023 Results.

Posted: Wed, 02 Aug 2023 20:30:00 GMT [source]

Shareholders holding common stock have voting rights (one vote per share) at the annual meeting, they get dividends when the corporation pays them, and they can sell their shares for a profit (or a loss). Although shareholders do not take part in the day-to-day running of the company, the company’s charter gives them some rights as owners of the company. One of these rights is the right to inspect the company’s books and financial records for the year. If shareholders have some concerns about how the top executives are running the company, they have a right to be granted access to its financial records.

The shareholder theory holds that a company’s sole responsibility is to maximise profits for its shareholders. This is the traditional understanding of a firm’s purpose, because many people buy shares in a firm solely to make the highest possible return on their investment. Both the phrases stockholder and shareholder apply to people who possess shares in a corporation, implying that they are part-owners.

Why It Is Important to Distinguish the Two Terms

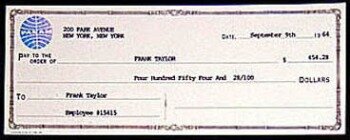

They can even do this as an individual, or they will approach as a group. If you were paid a dividend or other distribution from a corporation during the year, you will receive a Form 1099-DIV, Dividends and Distributions form. Give this form to your tax preparer or include it with other income on your tax return. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns.

- Profits within this business structure are taxed at the corporate level and at the personal level for shareholders.

- Shareholders have different responsibilities and implications depending on the type of company and the number of shares you own.

- To become a shareholder in a company, you should have owned at least one share in that company.

- The minimum eligibility to be counted as a shareholder requires owning at least one share in the stock of the corporation.

This is what it means to have a fiduciary duty as opposed to a general responsibility. Generally, a shareholder is a stakeholder of the company while a stakeholder is not necessarily a shareholder. A shareholder is a person who owns an equity stock in the company, and therefore, holds an ownership stake in the company.

Search form

Shareholders have what is known as a “capital interest” in a company’s performance. This also makes shareholders stakeholders, as they have a financial interest in the organization’s performance. Many people have a vested interest in the success of a company. If you own a portion of it, you want it to succeed because then you get a cut of the profits. Folk like that are called “shareholders.” If you have a financial interest in the company other than ownership, say you work for it, you still want it to succeed. Everyone who wants the corporation to succeed is called a “stakeholder.” Not every stakeholder is a shareholder.

You can become a shareholder by investing in a publicly traded company. In exchange for providing capital, companies offer shareholders certain rights to vote and make decisions about the company. On the other hand, stakeholder theory helps you act responsibly towards your employees, customers, and business partners.

How Shareholder Income Is Taxed

However, creditors, bondholders, and preferred stockholders have precedence over common stockholders, who may be left with nothing after all the debts are paid. A single shareholder who owns and controls more than 50% of a company’s outstanding shares is called a majority shareholder. In comparison, those who hold less than 50% of a company’s stock are classified as minority shareholders.

He might have owned shares in CITGO, but at 11 years old he probably wasn’t a key stakeholder for any major project teams. Warren Buffett bought his first stock in the spring of 1942—when he was just 11 years old. While other kids were playing baseball and trading comic books, Buffett purchased six shares of CITGO stock at $38 a piece and became a company shareholder for the first time. To become a shareholder in a company, you should have owned at least one share in that company. The main role of the shareholder is to invest their money in that company by purchasing its shares.

How to Calculate Stockholders’ Equity

Those lost jobs reduce the amount of income a family receives, even if the worker qualifies for unemployment. After all, there is a 1-week waiting period after a layoff occurs before a claim can be made and it is not a full income replacement. Let’s say XYZ Enterprises decides that their line of washing machines is no longer a profitable product to produce. They decide to stop making them altogether to focus on making only dryers instead. Shareholders of a company are entitled to certain rights as well. She has held multiple finance and banking classes for business schools and communities.

Also, shareholders would want the company to focus on expansion, acquisitions, mergers, and other activities that increase the company’s profitability and overall financial health. Examples of internal stakeholders include employees, shareholders, and managers. On the other hand, external stakeholders are parties that do not have a direct relationship with the company but may be affected by the actions of that company. Examples of external stakeholders include suppliers, creditors, and community and public groups. The investments that shareholders hold in a company are usually liquid and can be disposed of for a profit.

Stakeholder vs. Shareholder: Key Differences

If you prioritize short-term wins and revenue gains over everything else, you might sacrifice your company culture, business relationships, and customer satisfaction in the process. As a shareholder, you want to get the most financial return on your investment. That means you’re probably interested in how the company performs on a high level, because stock prices go up when the company does well. And when stock prices go up, you have an opportunity to sell your shares and make a profit. A majority shareholder owns and controls more than 50% of a company’s outstanding shares.

WhiteHorse Finance Anticipates Strong Earnings Results and … – Best Stocks

WhiteHorse Finance Anticipates Strong Earnings Results and ….

Posted: Wed, 02 Aug 2023 09:18:52 GMT [source]

If shareholders notice anything unusual in the financial records, they can sue the company directors and senior officers. Also, shareholders have a right to a proportionate allocation of proceeds when the company’s assets are sold either due to bankruptcy or dissolution. They, however, receive their share of the proceeds after creditors and preferred shareholders have been paid. Unlike common shareholders, they own a share of the company’s preferred stock and have no voting rights or any say in the way the company is managed.