You may want a local accountant, but if you live in a high-cost area, expect to pay a higher than average rate. But if hiring one is within your budget, you’ll save yourself hours of frustration and headache. However, as cost & profitability planning will likely indicate, hiring outside accountants is almost always significantly less expensive than hiring additional employees. And while you might cover some of these responsibilities, a good rule of thumb is that every time you’re dealing with the government – hire an accountant. We’ll form your company, get your EIN, and help you open your business bank account.

They also found that 40% of business owners say that bookkeeping and accounting are the worst part of running a small business. However, we can break down some costs to give you a clearer picture of what your small business accounting expenses can be. Even if you haven’t made money yet, creating a strong business plan could make or break the trajectory of your business (yet strangely, they’re not required to start a business). It’s up to you to take ownership of how you’ll plan your business.

Shop around if you think you can get a better price with a different accountant. Xendoo specializes in providing expert accounting and bookkeeping services to small businesses. Because this is our niche, we can deliver tried-and-true expertise. Because we know small businesses need affordable accounting services, we leverage accounting technology to reduce costs while maintaining gold standard quality. The more time they spend on your books, the more you have to pay. Owning a small business comes with all sorts of hoops to jump through, and bookkeeping and accounting often feels like one of the biggest hoops of all.

Accounting Fees Per Engagement

Bookkeepers are responsible for recording financial transactions, such as expenses and revenues, and keeping accurate financial records. They typically have less formal education and training than CPAs, but they still play a crucial role in managing a business’s finances. Bookkeepers often charge lower fees than CPAs, making them an affordable option for small businesses and startups. The difference in cost between an accountant and a tax preparer depends on the individual. Because a certified public accountant often can provide financial services beyond basic tax preparation, they may be more expensive than hiring a tax preparer to file basic taxes. When you pay a professional to do your taxes, you are getting the added benefit of numerous other services, including accounting, record-keeping, tax consultation, and auditing.

At TGG Accounting, our experienced financial experts are committed to the success of your business. Whether you need to hire one accountant or outsource your business finances to a whole team, we can help! Contact us today if you have any questions or are ready to get started. The two main things that determine an accountant’s rate are the services your business needs and the accountant’s qualifications.

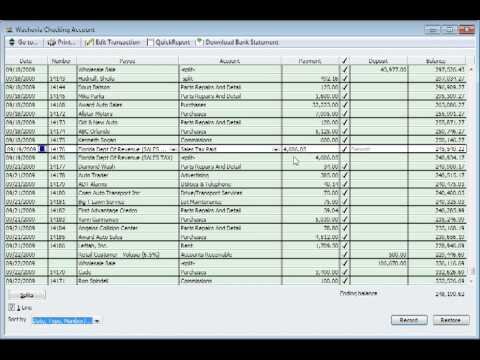

Small Business? Start With the Basics: Bookkeeping

Deciding when to hire an accountant and what’s a reasonable price to spend on accounting services can be difficult. But one way to paint a better picture of how much you’ll spend on accounting services is through a cost-benefit analysis. Start by finding Is Capital Debit or Credit the average hourly rate for a CPA in your city. Will you hire them on an hourly basis, or would it make more sense to pay a monthly fee? Remember that accountant fees will vary depending on their years of experience and the type of work they offer.

For example, you can record transactions and process payroll using online software. You enter amounts into the software, and the program computes totals for you. In some cases, payroll software for accountants allows your accountant to offer payroll processing for you at very little additional cost. Looking at average accounting fees is a great starting point, but there’s more that goes into setting your pricing than national averages. You also need to consider factors that directly impact your accounting services cost.

Business owners love Patriot’s award-winning payroll software. Although we’re here to bring you some quick fee-setting tips, the process itself probably won’t be lightning fast. Go ahead and take your time setting your prices to ensure you bill clients fairly. When marketing your accounting firm, remember to show off your experience and credentials to build trust and credibility.

If you’re fed up with trying to do your own books, you’re not alone. For many small business owners, accounting is definitely not an area of expertise. Although there is no standard accounting fee, here are some factors that influence the cost of hiring an accountant. Your books are simplified and accurate when you use accounting software. But, what happens if you enter a number incorrectly and don’t notice it?

Small business accountants help millions of business owners begin, run, and grow their start-ups into successful businesses. Their responsibilities range from collecting data to providing financial expertise, making an accountant an asset to your business operations. Save time and energy when organizing the finances of your start-up or small business with a professional accountant.

Stripe Fees: A Guide to Stripe Fee Structure for an Ecommerce Business

It’s easy to just accept and pay whatever accounting fees they charge – whether on a weekly, monthly, quarterly, or yearly basis. However, if you’ve not dealt with accountants before you might have concerns that you’re paying too much. This article will help you work out if your small business accountant fees are too high. Note, that bookkeepers tend to manage the day-to-day recording of financial data.

- Patriot’s online accounting for small business is easy-to-use and made for the non-accountant.

- If you’re registered as a sole trader, your accounting costs will be lower than those of a limited company.

- Your accounting firm location (and where clients are located) plays a role in accounting fee averages.

- If you’re just starting your business, you might need help selecting a business structure.

- Skilled in managing audits and leading teams to deliver exceptional services.

- Bookkeepers and accountants usually charge a fee per hour of service.

A more competitive price and a wider range of professionals make the search for candidates offshore such an attractive option. When it comes to location we have to figure out whether we want a face-to-face accountant or we are willing to hire remotely. If we are looking for someone to physically attend the office we’ll find different rates and salaries depending on the state and the number of candidates available. Also, hiring a face-to-face accountant comes with some additional costs like office space, equipment, and transport. If you fall within a certain income bracket or are a senior citizen, you may qualify for tax filing assistance.

Types of Accountants And What They Typically Charge

An in-house accountant can be part-time or full-time, depending on your business needs. This would be the most expensive option, as you would pay the individual a salary and add them onto your business’s payroll. We love working with small businesses and partnering to make them successful. We truly believe that every business deserves access to strategy and expertise, no matter how big or small they are, and Milestone puts that within your reach. As you can see, some businesses may only need the help of an accountant a few months out of the year. According to the Bureau of Labor Statistics, the average cost of an accountant is about $40 per hour.

Accounting

If you enter a number incorrectly and fail to notice it, you’ll end up with inaccurate financial reports and no clear insights into your business’s performance. Well, that depends on what you’re looking for and the expertise you require. If you need to hire an accountant, understanding the ins and outs of this dynamic field can help you make the decision and choose the most money-efficient for you. A good CPA should be able to analyze your specific tax situation and look for ways to help you save money on your taxes. Consider how changes to legislation may impact the way you file. For example, when the Tax Cuts and Jobs Act (TCJA) went into effect on Jan. 1, 2018, it made some sweeping changes to the tax code.

Listen to Budgets, Books & Balance Sheets

It’s essential that accounting firms use dependable outsourcing agencies with a steady choice method and an extensive pool of candidates. As we said, hiring remotely is one of the best ways to lower your accountant costs. Not only saves you money on office expenses, but you can access a greater variety of candidates by opening up the game to accounting professionals around the world. Again, the average amount an accountant charges depends on their pricing structure.

Accountants may also be more likely to get to know your life situation better, unearthing other opportunities for tax benefits that traditional tax software simply won’t explore. Purchasing tax accounting software can be a less expensive option; it can be free (for simple returns), and for more complex filing options, it will generally cost less than $120. Both TurboTax and H&R Block offer reasonably priced options for tax accounting software. Using tax accounting software can be like having a virtual accountant there to guide you through the process. The cost of hiring a professional accountant to do your taxes varies based on your situation and what tax forms you are required to file. If your tax situation is simple, say you work for a company and need to submit your W2s, it may cost less to hire an accountant.

Let your business degreed accountant assist you in growing your business. The business degree offers you valuable advice in accounting, marketing, finance, law, government, and most importantly, how to get along with others. Business is business attitude without tact and tolerance is not good for your business. Where possible, use software to handle some of your accounting responsibilities. This reduces the tasks you need an accountant to do, saving you money on accountant fees.

When you hire a CPA, you’ll have a detailed record of all financial transactions. This will help you to forecast any potential financial losses or gains. Your CPA knows your income sources as well as your financial outgoings. By helping you monitor where your money is going, they can advise on where you can cut costs. While there are some basic financial tasks you can handle yourself, there are others that it’s best to leave to a professional.

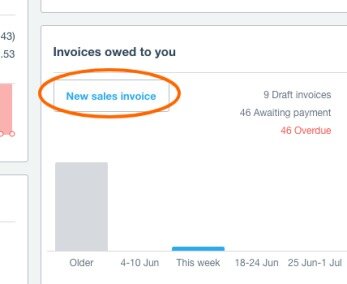

Now that we’ve got the “how much does an accountant cost” question out of the way, you can have a better understanding of how much you may have to pay for accounting services. Consider looking for accounting software with advanced features such as mileage tracking, invoicing, and time tracking. Accounting software could be a more budget-friendly option, even if you have to hire someone to manage the platform. For example, you might hire an accountant to audit your business and pay them per project or per hour if you need assistance in different areas. By translating your financial data into business information, they will be able to provide expert advice on how to improve your performance and grow your business for the next fiscal year. Accountants all around South America and Europe are offering their services remotely with fees well below the US average.

For more simple tasks such as balancing accounts, you could hire a bookkeeper as opposed to an accountant. A bookkeeper might cost $30 to $40 per hour, whereas an accountant could charge hundreds of dollars per hour. Fixed-fee structure pricing is where you pay a monthly fee for ongoing projects.